Update 16th Dec 2021: we’ve added a helpful reference table that describes how to manage tax for VAT, IOSS and VOEC to our knowledge hub.

As of 1st July 2021, the EU is changing the way it charges Value Added Tax (VAT) on cross-border transactions. These broad, sweeping changes affect most ecommerce businesses that operate in the EU. If your store sells to EU consumers or imports goods from outside of the EU for sale, these changes affect you.

Angry Creative can help WooCommerce stores with new VAT changes. They relate to the Brexit-related changes we wrote about in March. But, they also affect EU-based merchants.

One key change is the introduction of IOSS – the Import One Stop Shop. This is a service that allows merchants to charge, declare and pay VAT. Up until 1st July, goods under 22 EUR were VAT exempt – that exemption no longer applies. Merchants are now responsible for charging, collecting and paying VAT on all goods, with one exception.

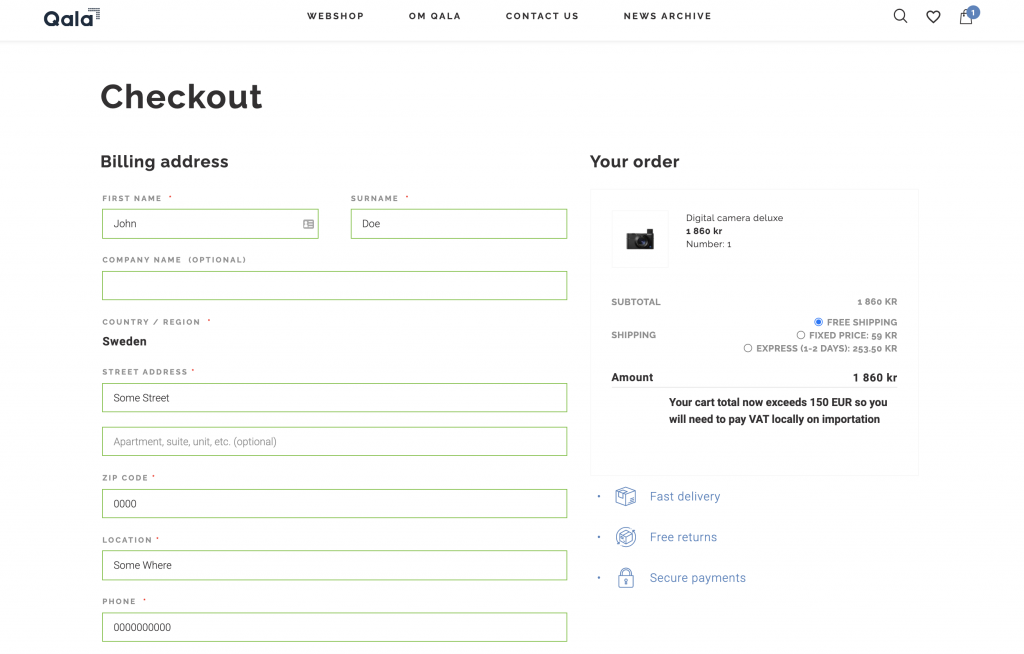

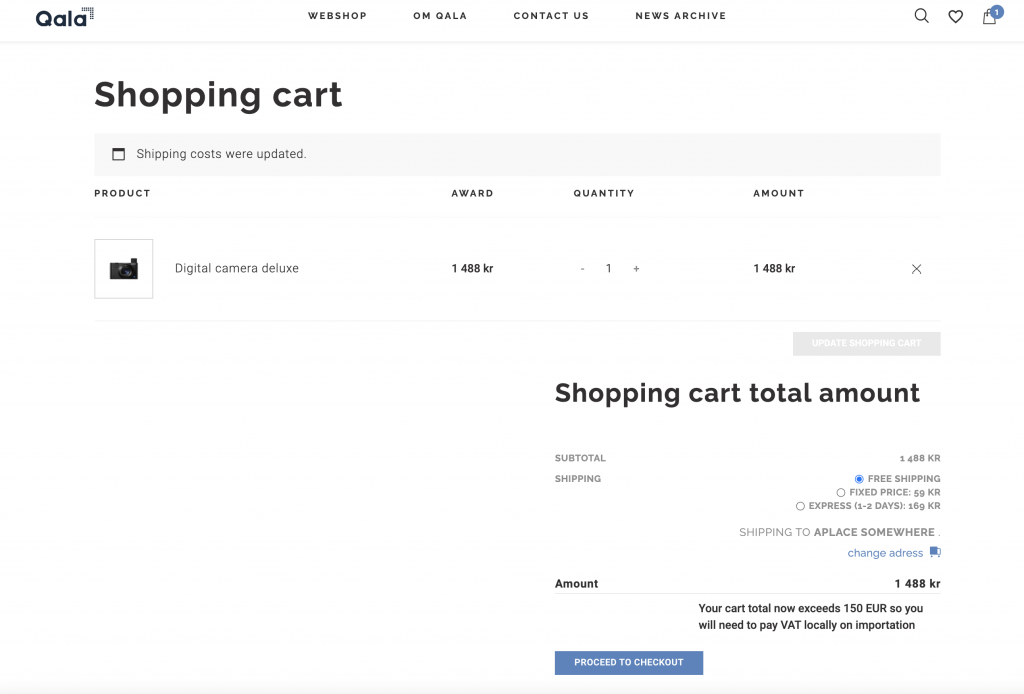

The exception is for single consignments to a single customer of one or more items that total more than 150 EUR. Here, merchants may choose not to charge VAT at the point of sale, leaving the VAT payable on import by the customer. Merchants may choose to collect VAT on all goods to simplify the checkout process. This avoids surprising their customers when they need to pay the VAT.

So in summary:

- If a merchant is sending a shipment worth less than 150 EUR, they must charge VAT at the point of sale.

- For single shipments of more than 150 EUR, a merchant can choose to charge VAT at point of sale or not.

Standard WooCommerce allows merchants to charge VAT on all purchases. The Angry Creative solution is for WooCommerce stores that choose not to charge VAT on shipments > 150 EUR. Here’s how it works:

- The plugin works with any WooCommerce store

- It uses the cart value pre-tax but including shipping costs. There is an option that lets you choose to include shipping or not.

- If the cart value is less than 150 EUR, the plugin applies VAT. This 150 EUR limit is configurable if merchants want to play it safe by using a 140 EUR limit for example.

- Supports any checkout currency by converting the cart value to EUR.

- Can display a configurable message to the user in the cart if under/over limit. E.g. ‘You are under the VAT limit, we’re not charging tax, you’ll have to pay that to your customs.’

- Includes this notice on the customer invoice and shipping slip too. Supports WooCommerce PDF Invoices & Packing Slips and PDF Invoices.

- Works with tax-inclusive/exclusive product inventory (this is a WooCommerce configuration option).

IOSS is not the only VAT-related change that comes into effect on 1st July 2021. But it is the one that most affects the checkout process for consumers. Our solution is cost-effective and helps merchants stay compliant with IOSS rules.

You may also want to check out the One Stop Shop for WooCommerce plugin which can help with the reporting aspect of the OSS system.

We’re going to open source this plugin when we can but for now it needs developer-level configuration and documentation so we can’t release it or distribute it for free. Please contact the Angry Creative sales team for more information. Please use [email protected] or reach out using our contact form.